The deeper a family’s debt becomes, the more they borrow and spend.

Another reality is that the annual deficits continue to increase as the federal government continues to borrow and spend. This will push the national debt even higher. Another reality is that the U.S. deficit for the current fiscal year has reached almost $2 trillion, which is nearly double the previous record deficits prior to the COVID-19 Pandemic. Federal borrowing now exceeds $5 billion per day. There’s no end to the crisis.

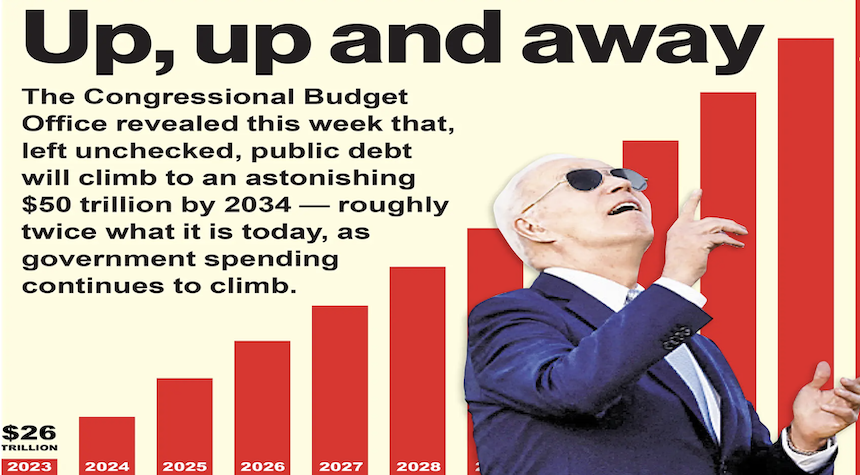

U.S. Congressional Budget Office reports that the federal budget deficit in fiscal year 2024 will be estimated at $1.8 trillion, which is $139 billion more than the deficit of the previous year. This is troubling but not surprising news, as the national debt continues its upward trend and now stands at close to $36 trillion.

Here’s the question that is both necessary and touchy: Do either of these parties care about this issue? Do you mean care enough to take action? I’m not sure. We’ll get there.

Maya MacGuineas is the president of the Committee for a Responsible Federal Budget. She made a statement Tuesday.

In 2025, legislators will have to overcome new challenges. In addition to rising debt, interest rates, and deficits, 2025 will see the reinstatement and removal of the Fiscal Responsibility Act budget caps and the expiration of major tax and expenditure laws. In the next 12 years, three trust funds for highways and Medicare will be depleted, forcing us into even more difficult decisions about how to maintain important government priorities.

The policymakers will be put to the test by these hurdles, as they must either find real savings to offset the desired results or pass on the cost to the next generation.

We can’t continue borrowing at this rate forever. It’s long past time for policymakers to stop adding to the growing national debt. Instead, they should agree on a way forward that will put debt on a downward and sustainable path for future generations.

Both parties are kicking the can down to the next election. Democrats propose ever more spending while Republicans compromise on more expensive legislation.

It’s not about increasing taxes. It’s about reducing spending.

To the chagrin of the Democrat Party (as if it cared), the CBO report shows that it is not about raising taxes on the evil wealthy, and devilish corporations, who do not pay their “fair shares,” but about reducing expenditure.

- The combined tax on individual income and payroll increased by $343 billion (9%).

- The amount withheld from employees’ paychecks has increased by $156 billion (5%) reflecting increases in wages and salary.

- This increase is due to the delayed payments made by taxpayers who live in natural disaster-affected areas. The Internal Revenue Service (IRS), starting in February 2023 has extended some filing deadlines for 2023. The majority of these payments were due in November 2023.

- The Employee Retention Tax Credit was a major factor in the decline of individual income tax refunds by $77 billion (or 21%), as a result of a moratorium on new claims. This increased refunds for individuals in 2023. The IRS announced this moratorium in September 2023.

- Net corporate income tax receipts increased by $109 billion or 26 percent.

While writing this article, a quote by the late British Prime Minister Margaret Thatcher came to mind.

Socialism has the problem that it eventually runs out of money.

The Democrat Party is oblivious to this reality, while Republicans talk tough and ultimately compromise far more than they had promised.

Conclusion:

Politics aside, regardless of who wins the election in November – Donald Trump or Kamala Harri – the next president will have to make tough fiscal decisions. Harris proposes to increase taxes on high-income families and corporations, while Trump speaks of new tariffs and tax cuts and the elimination of fraudulent spending.

The out-of-control band continues to play.