Americans are suffering from inflation, as food prices have risen to an all-time high of $42 per day in July.

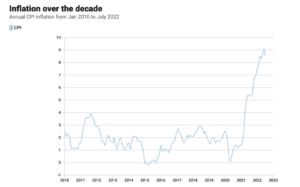

Although the consumer price index, which measures a basket of everyday goods including food, rent, and gasoline, came in cooler than expected at 8.5% in July, food prices accelerated further, the Labor Department reported on Wednesday. The food at home category, which tracks the cost of groceries, surged 13.1% over the last year, the most significant increase since March 1979. On a monthly basis, prices jumped 1.4%.

Greg McBride chief financial analyst at Bankrate.com stated that consumers are receiving a discount at the gas station, but not at their grocery store. “Food prices and costs, especially for food at home continue to rise at the fastest rate in over 43 years.”

Americans are spending more to buy a variety of products that have increased in price significantly over the last year. This includes staples such as eggs (38%), meat (16.6%), milk (15.6%), potatoes (13.3%), and rice (12.7%). Fresh fruits and vegetables are (8.2%).

The Russian war in Ukraine has caused an unprecedented rise in food prices. This is partly due to the fact that grain shipments from Ukraine’s largest supplier, Russia, have been limited.

Rising food prices are one of the most glaring reminders of rising inflation. This has caused severe financial pressures in most U.S. households. Low-income Americans are most affected by price fluctuations. This is especially true for essentials like food and fuel.

Another worrying sign was Thursday’s release of data by the Labor Department that tracks inflation at the wholesale level. It showed that food prices rose 1% in July, the fastest increase in four years. This gauge, also known as the producer-price index, tracks price movements before they reach consumers at the retail level. It may indicate that there will be price increases for both consumers and businesses.

Seema Shah (chief global strategist, Principal Global Investors) stated that inflation will continue to decline at a slow and painful pace. “Food and energy inflation can be unpredictable. While inflation should be at its peak soon, the stickiness and broadening of price pressures mean headline CPI will not fall below 6.5% this year before the recession accelerates the decline by 2023.