Joe Biden had a lot going for him when he took office. The COVID-19 vaccine was available and the pandemic shutdowns were lifted. This allowed the economy to start roaring again. But economic prosperity never came. Instead, we had crippling inflation that has hurt everyone.

Bidenomics has an impact on everyone. A new report claims that the average American renter cannot afford to live in a typical apartment.

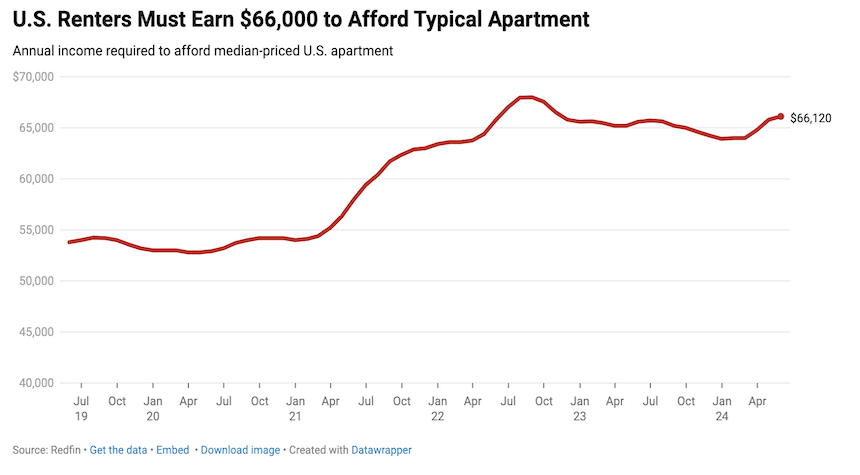

Redfin reports that the average U.S. renter earns $54,712 annually, which is 17.3% lower than the $66,120 required to afford the median apartment, priced at $1,653 a month. Renters in the United States can’t afford to pay their rent without financial strain.

This report is based on an analysis by Redfin of median U.S. asking rents in the three months ending May 31, 2020 (referred to as “May” within this report) and estimated median household incomes (referred to as “renters”, throughout this document). The data used to estimate 2023-2024 household median incomes was derived from the U.S. Census Bureau’s 2022 data, the most recent year for which data is available. We also used Atlanta Federal Reserve wage data covering the lower half of the wage scale. Renters are considered affordable if they spend no more than 30 percent of their income (which is equivalent to their annual income being at least 40 times the monthly rent).

Renters’ incomes required to afford a median-priced apartment are at their highest level since October 20, 22. The asking rents are up 22.9% since May 2019 (before the pandemic) and 0.8% over the past year. In May, the median U.S. asking rent for an apartment was $1653, just $47 short of its previous record. Rent growth is basically flat.

This problem is exacerbated by the inflation that has risen during Biden’s tenure as president. Renters are left with less money to pay for housing due to rising costs of essentials such as food, gas, and utilities. The Biden administration, despite promises to tackle affordability and economic inequalities, has continued to claim that inflation has decreased and wage growth is outpacing it. This is not true. Biden has made financial stability for Americans more difficult.

The chart below shows that the income required to afford an apartment priced at the median in the United States was flat in 2020, but started to rise after Joe Biden became president.

The income required to afford an average apartment has decreased in the past year, but it is rising again. Rents fell below $1,600 in December 2023 and the income required to afford a typical apartment dropped to $63,920. However, this was still out of reach for many. Rents initially dropped due to the pandemic, as multifamily construction boomed. Rents are now rising again, in part due to a resilient demand.

Sheharyar Bukhari, Senior Economist at Redfin, believes that rent increases should be outpaced by wage growth, and this will narrow the affordability gap.

Bokhari stated, “Many U.S. tenants are and will continue to be burdened with the cost of having a roof over their heads, and unlike homeowners, they do not build wealth through increasing property values.”